Best Australian Forex Brokers 2022

Listings that appear on this page and/or on this website are of products / companies / services from which this website may receive compensation. This may impact how, where and which products / companies / services we review and write about. This page may not include all available products, all companies or all services.

While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money.

While there is a magnitude of brokers to choose from on the internet, many beginner Australian traders will find it difficult to know which are the right brokers, who will be a true partner to them. It’s hard to know just which broker to trade with in Australia. FX Empire is here to help you decide exactly who to choose as your trusted trading partner. With the insight of our readers from across Australia and the in depth research of our experts we have created a list of the best, most trustworthy and technologically advanced brokers in Australia.

The brokers below represent the best forex brokers in Australia

Pro Tip: Most of these brokers offer free demo accounts so you can test the brokers and their platforms with virtual money. Give it a try with some play money before using your own cash.

Here’s a list of The Best Forex Brokers in Australia

Note: Not all Forex brokers accept US clients. For your convenience we specified those that accept US Forex traders as clients.

IC Markets

Owned by International Capital Markets PTY, the IC Markets brand was founded in 2007. The platform operates under the AFSL license number 335692 issued by the Australian Securities & Investment Commission (ASIC). Its head office is located at Level 6 309 Kent Street Sydney, NSW. The broker also maintains an office in Limassol Cyprus.

For market access, IC Markets offers 3 main types of trading platforms, the MetaTrader 4, the MetaTrader 5 and cTrader platforms. Both the MT4 and MT5 are proven trading platforms with a high level of reliability. As for the cTrader, the platform was designed especially for true ECN connectivity. Other advantages of IC Markets include low spreads and high leverage ratio. The broker is also well known for offering its traders a complete educational center.

Eightcap

Eightcap Pty Ltd was founded in 2009 in Australia. The broker is authorised and regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

The broker offers clients the ability to trade on more than 300+ financial CFD instruments covering Forex, Indices, Commodities, Shares and Cryptocurrencies through the MetaTrader 4 and MetaTrader 5 trading platforms for Web (MT5 only), PC, MAC and Mobile.

- ASIC regulated.

- Commission-free trading available with competitive spreads.

- 200+ financial CFD instruments.

- MetaTrader 4 and MetaTrader 5 available.

- VFSC regulated.

TMGM is authorised and regulated in various jurisdictions including the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). It also holds an Australian Financial Services Licence and segregates client funds from its own, holding them with tier 1 Australian banks Westpac and National Australia Bank.

With TMGM, users can trade on more than 15,000+ financial CFD instruments covering 7 asset classes including Forex, Metals, Energies, Cryptocurrencies, Commodities, Indices and Shares from the US, Australia and Hong Kong. This can be done from 2 types of trading accounts. The Edge Account offers commission-based trading of $7 per round turn and raw spreads from 0 pips while the Classic Account offers commission-free trading with spreads from 1 pip.

- 15,000+ financial instruments to trade on

- Commission-free trading available

- ECN trading accounts

- MT4/MT5 and IRESS trading platform

- 24/5 customer service

- Limited trader research and education resources.

FP Markets

FP Markets is an online forex and CFDs trading platform that is owned by First Prudential Markets Pty. The holding company is an Australian based company with its head office located at Level 5, Exchange House, 10 Bridge St, Sydney NSW. Founded in 2005, FP Markets is regulated by ASIC and holds an Australian Financial Services License (AFSL) number 286354. Apart from offering its traders the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, the broker also offers them the Iress trader platform.

Spreads on FP Markets starts from as low as zero pip as the broker claims to offer true ECN connectivity. Traders at FP Markets also have a selection of trading accounts to choose from, whether it is for spot forex trading or for CFDs trading.

- 3 types of trading platforms to choose from

- Competitive spreads

- ECN trading available

- Multiple choices of trading accounts

- No proprietary platforms, only MetaTrader

- Limited list of assets

GO Markets

The GO Markets trading offering is mainly geared towards professional traders. The competitive fees and access to advanced trading platforms such as MetaTrader 4 and third-party analytic tools are designed with advanced traders in mind.

However, beginner traders will also enjoy the commission-free trading accounts and competitive spreads, as well as live trading webinars and trading courses from the GO Trade Academy.

AvaTrade

AvaTrade was founded in 2006 and is authorised and regulated across all six continents it operates including by the CBI, BVI FSC, ASIC, FSCA, FSA and ADGM. It is one of the oldest online forex and CFD brokers with a well-established reputation for customer support, competitive fees and spreads – all in addition to offering a large range of financial instruments, even including ETFs and FX options for those who like to diversify across assets.

Users can choose to open several different account types – Retail, Professional, Spread betting and Options. The differences are discussed in the account opening section below. Retail, professional accounts offer access to over 1,250+ financial instruments across the AvaTrade propriety web-based platform, MetaTrader 4 and MetaTrader 5. Additional platforms include DupliTrade, AvaTradeGo, AvaOptions and AvaSocial, all of which are discussed further down this review.

- Global regulation – CBI, BVI FSC, ASIC, FSCA, FSA and ADGM.

- A wide selection of platforms for every type of trader including MT4/MT5.

- Competitive spreads and fees.

- Multilingual customer support.

- Not available to residents in the USA and Iran.

FXCC was founded in 2010 and operates as a joint brand name of FX Central Clearing Ltd which is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) and Central Clearing Ltd which is authorised and regulated by the Vanuatu Financial Services Commission (VFSC).

FXCC offers clients access to trade on more than 100+ financial instruments covering Forex, CFDs for Indices, Metals, Energies and Cryptocurrencies all through the globally popular MetaTrader 4 platform.

Clients are offered a single account type called ECN XL which includes commission-free trading, $50 minimum deposit, up to 1:500 leverage, variable spreads from 0.0, free funding and more. Islamic and demo accounts are also available.

How to Choose a Forex Broker (as an Aussie trader)

- The most important factor to look for in a broker is to see if the broker is regulated by the Australian Securities and Investment Commission (ASIC). ASIC is the regulatory body that is in charge of regulating the Australian financial industry. ASIC is also tasked with consumer protection as well as corporate governance which helps to ensure that your rights as a consumer are not abused by the brokers.

- Apart from regulatory oversight, you should also ensure that the broker has provided you with a reliable trading platform. The trading platform is every trader’s gateway to the financial markets and without a reliable platform, one will not be able to trade effectively.

- Finally, look at the spreads or commissions that the broker is charging. If the broker charges high spreads or commission, then your profitability will be affected. To help our Australian readers get a head start, we have compiled a list of recommended brokers that are based in Australia.

Australian inhabitants have often demonstrated resourcefulness in overcoming the numerous hurdles of living in such a sparsely populated area. Over the last 10 years with China’s economy booming at a furious rate, this has resulted in an upswing of exports from Australia and the appreciation of the Australian dollar. As a result, many Australians seeking to gain from the gain in the Australian dollar have taken to retail forex trading. This increased interest in retail forex trading goes to explain why the retail forex trading industry in Australia has been growing at a tremendous pace in recent years.

When it comes to selecting a Forex broker, there are a variety of things to bear in mind. Over the course of this article we will explore the key areas you as an Australian trader should be aware of when it comes to selecting a Forex Broker that will be a true partner to you. We will look at the Australian regulation of brokers, the importance of working with a locally regulated broker, how to choose the best trading platform to trade with, and other key areas such as commissions, spreads and leverage offered by the broker, plus the importance of good customer support.

General Regulations & Australia Regulation

Generally speaking in the online forex trading industry, the untrustworthy brokers tend to be unregulated. To attract your patronage, they often make outrageous claims which they fail to deliver on further down the road. Because of the high risks of getting scammed by an unregulated broker, your search for a reliable and dependable broker should start with those brokers which are regulated.

The Forex market is an over the counter (OTC) market. This means that the market is not regulated by any central regulatory body. In fact before Forex trading became popular on the retail level, Forex trading was largely confined to an institutional level and is largely self regulatory. But as Forex trading became more popular on a retail level, financial regulatory agencies in the more developed economies around the world began to step in, in an effort to protect the interest of the small retail investors.

Some of the standards which financial regulatory agencies around the world have established for Forex brokers operating in their jurisdictions include requiring the broker to have segregated accounts for their clients and the company’s operational funds. This requirement helps to ensure that the broker does not misuse the trading funds that have been entrusted to it by the clients. In other words, traders can rest assured that their funds will be in their trading account whenever they want to make a trade.

In addition, having segregated accounts helps to protect the clients money from being used to pay the broker’s debts, in the event the broker becomes insolvent. In other words, creditors of the broker are not permitted to claim the funds in these segregated accounts as part of the broker’s assets which can be used to pay off the broker’s debt. Another standard industry requirement for a regulated forex broker is the maintenance of a capital adequacy ratio. The purpose of requiring brokers to maintain a capital adequacy ratio is to ensure that the broker will at all time have sufficient liquidity to meet its contractual obligations.

Australian Securities and Investment Commission (ASIC)

For traders in Australia, the regulatory authority which they should take note off is the Australian Securities and Investment Commission (ASIC). Established in 1998 under the Australian Securities and Investments Commission Act, 2001, ASIC is empowered by the Corporations Act, 2001, the Insurance Contracts Act, 1984 and the National Consumer Credit Protection Act, 2009 to be responsible for the following in the financial industry in Australia:

- Consumer Protection

- Corporate Governance

- Promotion Financial Literacy

- Regulating Financial Services

- Regulating Insurance Industry

- Regulating the trading Securities and Derivatives

If you are a beginner trader who is unfamiliar with the online forex trading industry, the best starting point for you is to deal only with ASIC regulated brokers. Regardless of how attractive an unregulated forex broker’s offer may be, there is no point in taking up their “offers” if at the end of the day you find yourself unable to get your money back. Go for the benefits of an ASIC regulated broker which can provide you with peace of mind.

Trading Platform & Software

The next factor to take into consideration when selecting the best forex brokers in Australia to partner with is the performance of their trading platforms. The trading platform is your gateway to the forex market and without a reliable and efficient trading platform, you will not be able to trade the forex market effectively.

What are the main types of trading platform that the broker has provided. Here we are referring to:

Do you have to download a client software such as the MetaTrader 4 client software before you can use the trading platform? This means you can only use that platform from the computer that you have originally downloaded to.

Or is it a web based platform which only requires you to use a web browser to connect to the trading platform? This means you can literally trade from anywhere that you have internet connection. You will login using your username and password.

These are usually a stripped down version of the download or web based trader specifically built for the smartphone or tablet. Additionally some brokers offer their platform as an app which can be downloaded through the app store or Google Play.

In addition, consider if the trading platform is proprietary or a generic platform widely used by the industry.

Proprietary Platform

A proprietary platform can be indicative of the broker’s willingness to invest to improve the quality of its clients trading experience. This is a platform that the broker designs and builds for the use of their traders. It is often highly customizable to the user and can cater for all level of traders.

Generic Platform

Often called a white label this is a platform offered by many brokers and branded to them eg, with their logo. The most popular version of this is the MetaTrader 4 provided by Metaquotes. Sirix Trader and cTrader are the next most popular white labeled platforms.

Things to look for in your platform:

- Check if the trading platform is easy to use and executes trades instantly

- Can provide you with a wide array of trading tools to enhance your market analysis

- Look at the quality of the trading charts and see if they can provide you with an in-depth look of the price movements

- Additional tools which further extend your trading capabilities such as economic calendar, currency and pip calculator, updating news stream, trading directly from charts.

If in doubt about the above refer to the below list before you select a platform to trade on:

- Comprehensive charts

- Fast Execution of trades

- Mobile capable

- User Friendly Interface

- Wide range of trading tools

Commissions, Spreads & Leverage

With trading costs being one of the main factors which determine a trader’s profitability, most forex traders’ first instinct is to look at the commissions that brokers charge as well as the spread that they offer. Depending on the broker’s business model, most brokers do not charge any commissions. Instead, their main source of revenue will be the spread which traders pay each time they make a trade. The spread is merely the difference between the BID and ASK price. For frequently traded currency pairs, the spreads which a trader pays can range from zero pip to 5 pips. In addition when evaluating the spreads offered by the broker, check if the spreads offered is fixed or variable. For traders who wants certainty with their trading cost, it is better to opt for fixed spreads as they do not change according to market volatility as opposed to variable spreads.

Commissions

Although most brokers do not charge any commissions, this is not the case with brokers who offer ECN trading capacity. An Electronic Communications Network or ECN broker allow traders to deal directly with the liquidity providers hence allowing then to take advantage of the interbank rates offered by the liquidity providers. To compensate for the loss of revenue by giving traders direct access to interbank rates, ECN broker’s charge a small commission instead. This commission can be fixed or based on a percentage of the trading volume.

Leverage

The leverage ratio offered by forex brokers is also another important consideration to take into account. For Australian traders, the leverage enjoyed by them is considerably higher than what most brokers in Europe are offering their clients. Most European brokers due to regulatory restrictions are only permitted to offer their clients up to a maximum of 1:100 leverage ratio. Whereas for Australian regulated brokers, they are permitted to offer a maximum of 1:500 leverage ratio.

Account Types

The types of trading accounts offered by forex brokers depend on the target market which the broker is targeting. For beginner friendly brokers, the type of trading accounts offered usually have a low minimum deposit requirement as well as the ability to trade in small amounts or lots. For premium brokers, the account opening requirements is usually higher and often beyond the financial capability of the small retail trader. Nevertheless, the services offered by these premium brokers are usually personalized and exceptional. In addition when looking at the types of trading accounts that are provided by a broker, always make it a point to study their withdrawal policies and ensure that you are comfortable and agreeable with the terms provided. Some brokers may provide free withdrawals while others may charge their clients a high fee each time their clients makes a withdrawal request. Finally, check how long a broker usually takes to process a withdrawal request. Most regulated brokers usually take 3 business days to process a withdrawal request whereas some process a withdrawal within the same day.

Customer Service

It should be noted that the forex market is a 24 hours market with continuous trading activities going on throughout the entire trading day. Because of this, you want to ensure that your broker is capable of supporting you on a 24 hours basis and not just during office hours. Furthermore, check if the broker provides multiple methods of communicating with the support team. The more methods that the broker has made available, the more accessible the broker is when you have to contact the support team for assistance. Other factors to consider with regards to a broker’s customer support service are whether the broker provides multilingual support and localized support telephone numbers.

Additional Services

In a competitive industry such as the online forex trading industry, most forex brokers try to provide additional services in order to help them differentiate their services from other brokers in the industry. Some of the added features or benefits provided by these brokers may include the following:

- Free Trading Alerts

- Free VPS

- Interest on trading account balance

- Loyalty program and rebates on trading cost

- Market Analysis

- Market commentary

- One to One Consultation with in house expert

- Robot or Signal Trading Services

- Sign up Bonuses

- Social Trading Support

- Trading Competition

Conclusion

Because of the proliferation of forex brokers on the internet over the last decade or so, many beginner traders find it difficult to differentiate between the various types of brokers in the industry. To help our readers make the right choice, we have conducted in depth reviews of various brokers in the industry based on the guidelines that we have mentioned in this guide. Our goal is to provide you with a shortlist of brokers that meet a high operating standard as well as being able to meet all the traders’ trading requirements.

Always be wary of brokers that make outrageous claims such as “Risk Free Trading” or “Guaranteed Profits” as risks will always be present when trading the financial markets. Remember, no one can guarantee your profits. As an Australian trader, the best forex brokers to trade with in Australia are those brokers which have taken the initiative to be regulated by ASIC. This shows that the broker is willing to invest time and effort to gain their clients’ trust as well as to protect the legal interests of their clients. In other words, they are not fly by night operators that will disappear with your money. Lastly, by trading with ASIC regulated forex brokers, you will have fewer difficulties in referring any complaints that you might have about your broker to ASIC.

Брокеры Австралии от трейдеров Masterforex-V

Брокеры форекс Австралии — это брокерские компании, которые дают возможность австралийским (и не только) трейдерам и инвесторам при помощи специализированных торговых программ, получить доступ к фондовым, валютным и фьючерсным рынкам для торговли и получения прибыли.

Какие условия торговли предоставляют австралийские брокеры, какие трудности поджидают трейдеров при открытии счета у этих брокеров — наш новый материал wiki Masterforex-V.

Брокеров, которые работают на форекс рынке Австралии можно разбить на 2 группы: работающие де-юре, т.е. те, которые имеют лицензию от авторитетного в мире регулятора ASIC и работающие де-факто, т.е те брокеры, которые имеют зарубежную регистрацию и лицензию, но также и позволяющим открывать счета и гражданам Австралии.

Брокеры Австралии с лицензией ASIC

На данный момент регулятор ASIC (Australian Securities and Investments Commission) имеет достаточно серьезные критерии оценки брокеров на уровне американского регулятора NFA, что подтверждается тем, что за последние 2 года (2018-2020гг) он не выдал ни одной новой лицензии. С другой стороны, это означает, что если компания имеет лицензию ASIC, то можно быть уверенным, что компания является безопасной для розничной торговли на Форекс.

Среди компаний, имеющие лицензию от регулятора ASIC, выделяются Swissquote Bank SA, Saxo Bank, Dukascopy Bank SA, Credit Suisse AG, FP Markets, Vantage FX, IC Markets, Anzo Capital, GO MARKETS, Pepperstone, Think Markets, EightCap, INGOT Brokers, CityIndex, FXOpen, Rakuten Securities, IG Markets, OANDA, IFS Markets, AvaTrade, Admiral Markets, XM Group, Global Prime, FXCM, AxiTrader, CoreSpreads, CMC Markets, Aetos, Plus500, BCR, Markets.com, MultiBank Group, IronFX и другие.

Преимущества и недостатки австралийских форекс-брокеров

Торговля со австралийскими брокерами имеет свои преимущества:

- депозиты трейдеров защищены австралийским законодательством на 250 000 австралийских долларов (около 170000 долларов США);

- брокеры обязаны предоставляет документы для налоговой инспекции;

- поддержка трейдеров и документация на английском языке;

- нет ограничений по кредитному плечу (подробней в статье «Кредитное плечо на форексе и крипто: заблуждения интернета и оценки Masterforex-V»);

- нет запрета на хеджирование;

- счета клиентов и собственные счета разделены и размещены в банках первого уровня;

- физическое расположение офиса в Австралии;

- пополнение депозитов через внутренние переводы и экспресс-платежи в национальной валюте — австралийском долларе, евро, долларах США.

Недостатки брокеров Австралии такие же, как и других международных брокеров:

- более высокие требования к размеру депозита;

- более высокие комиссии;

- меньше выбор торговых инструментов.

Форекс-брокеры Австралии в рейтинге Masterforex-V

Из выше перечисленных брокеров, только несколько (Dukascopy, Swissquote, FXCM, OANDA, Saxo Bank) находятся в высшей лиге рейтинга брокеров Форекс Академии Masterforex-V с наивысшими баллами как от ректората Академии, так и от трейдеров, а остальные расположены во второй или в третьей лигах.

Почему так произошло?

Во 2-3 лиге рейтинга брокеров Masterforex-V находятся брокеры, имеющие большое количество претензий от трейдеров и инвесторов.

Например, такие брокеры имеют следующие недостатки:

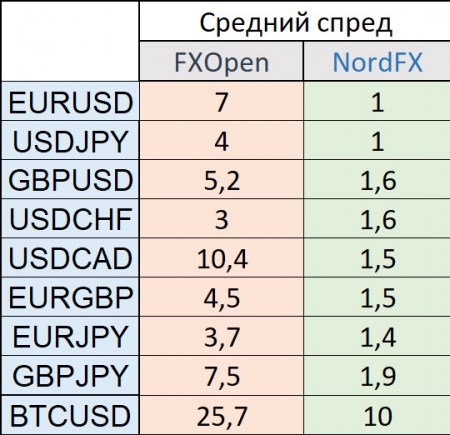

- Высокие спрэды, если сравнивать со спредами брокеров из высшей лиги, посмотрите спреды AvaTrade или FXOpen и их ближайшего конкурента — NordFX — по некоторым парам спреды превышают в 3-7 раз:

Брокеры, без лицензии ASIC , но предоставляющие услуги форекс в Австралии

Если по каким-то причинам трейдеры из Австралии не хотят пользоваться услугами брокеров с лицензией ASIC, они без проблем могут выбрать других брокеров для торговли, которые имеют европейские (AMF, FCA, BaFin, FMA, FINMA и др) американские ( SEC, NFA, IIROC) лицензии.

Какого брокера выбрать, подсказать рейтинг брокеров Форекс Академии Masterforex-V, который основывается на более чем 20 объективных критериях оценки работы брокеров. Так, все брокеры, доступные в Австралии разделены на

- высшую лигу — где присутствуют 12 рекомендованных рейтингом или «Лучших брокеров форекс»;

- вторую лигу — где можно выделить 68 популярных брокеров, которые имеют многочисленные претензии со стороны трейдеров и инвесторов;

- третью лигу — более 70 мало популярных или почти не известных, а также скандально известных брокерских компаний, досье которых присутствует, но Академия Masterforex-V настоятельно не рекомендует открывать у них торговые счета.

У таких форекс брокеров достаточно широкий выбор инструментов для торговли. Присутствуют

Брокеры фондового рынка Австралии

Брокеры с лицензиями JFSA и JSDA (такие как Swissquote Bank SA, Saxo Bank, Dukascopy Bank SA) уже могут предложить следующие инструменты фондового рынка: ETF-фонды, CFD-контракты на финансовые активы, облигации, акции, фондовые индексы — привилегированные акции, голубые фишки и т.д., а с помощью интернет, трейдеры могут получить доступ к многочисленным рынкам мира с возможностью торговать варрантами, казначейскими векселями, форвардными контрактами, сделками РЕПО, депозитарными расписками и т.д. Такие брокеры могут предоставить доступ к более чем 40 мировым биржам и возможность торговать тысячами финансовых инструментов:

| Биржа | Индекс | Биржа | Индекс |

|---|---|---|---|

| Северная Америка | Ближний и Средний Восток | ||

| NYSE (Нью-Йоркская фондовая биржа) | Dow Jones 30, S&P 500 | BIST (Стамбульская биржа) | BIST 30, BIST 100 |

| NASDAQ | NASDAQ 100, NASDAQ National Market Composite, NASDAQ Biotechnology Index | TASE (Тель-Авивская фондовая биржа) | ТА 35 |

| TSX (Фондовая биржа Торонто) | S&P/TSX 60 | QSE (Катарская фондовая биржа) | QE index |

| BMV (Мексиканская фондовая биржа) | S&P / BMV IPC, S&P / BMV INMEX | ADX (Фондовая биржа Абу-Даби) | ADI |

| Tadawul (Саудовская фондовая биржа) | TASI, SAR | ||

| Южная Америка | |||

| Brasil Bolsa Balcao (Фондовая биржа Сан-Паулу) | Ibovespa | Европа | |

| BCS (Фондовая биржа Сантьяго) | IGPA, IPSA | LSE (Лондонская фондовая биржа) | FTSE 100 |

| Euronext | Euronext 100, CAC 40, BEL 20, AEX 25, PSI 20, ISEQ 20 | ||

| Азия | FSE (Франкфуртская фондовая биржа) | DAX 30, Euro Stoxx 50, MDAX, TecDAX | |

| BSE (Бомбейская фондовая биржа) | BSE SENSEX 30 | BME (Мадридская фондовая биржа) | IBEX 35, IGBM |

| NSE (Национальная фондовая биржа Индии) | NIFTY 50, NIFTY Next 50, NIFTY 100 | MOEX (Московская Биржа ММВБ-РТС) | IMOEX, RTS, MOEXBC |

| KLSE (Малайзийская биржа) | FTSE Bursa Malaysia KLCI | SWX (Швейцарская фондовая биржа) | SMI 20 |

| TWSE (Тайваньская фондовая биржа) | TAIEX | WBAG (Венская фондовая биржа) | ATX |

| KRX (Корейская фондовая биржа) | KOSPI, KOSDAQ | OSE (Фондовая биржа Осло) | OBX25 |

| HOSE (Фондовая биржа Хошимина) | VN Index | GPW (Варшавская фондовая биржа) | WIG 20, WIG |

| TSE (Токийская фондовая биржа) | NIKKEI 225, TOPIX Core 30 | ||

| SSE (Шанхайская фондовая биржа) | SSE Composite, SSE 50 | Австралия | |

| SZSE (Шэньчжэньская фондовая биржа) | SZI | NZX (Новозеландская биржа) | S&P/NZX 10, S&P/NZX 50 |

| HKE (Гонконгская фондовая биржа) | HSI | ASX (Австралийская биржа ценных бумаг) | S&P/ASX 200, S&P/ASX 20 |

| SGX (Сингапурская биржа) | STI | ||

| PSE (Филиппинская фондовая биржа) | PSEi | Африка | |

| SET (Фондовая биржа Таиланда) | SET | JSE (Йоханнесбургская фондовая биржа) | JTOPI |

Среди таких брокеров можно выделить:

Saxo Bank, Dukascopy, NordFX, Swissquote, Interactive Brokers, FxPro, Oanda, FOREX.com, FIBO Group, FXCM, Alpari и др.

Брокеры товарного рынка Австралии

Кроме тех, что были названы ранее — Interactive Brokers, HYCM, FIBO Group, Oanda, Saxo Bank,Alpari, FOREX.com, Swissquote и др. возможность торговать товарными фьючерсами или CFD вам могут предложить такие брокеры как: TeleTrade, AMarkets, EXNESS, InstaForex, FortFS, FreshForex, CapTrader, IC Markets, Pepperstone и др.

Брокеры криптовалют в Австралии

Брокеры, предлагающие доступ к рынку форекс в Австралии также предоставляют возможность торговать и криптовалютами, например такими как Ripple XRP, OMG, BCH, биткоином BTC, Litecoin, ADA, EOS, TRON TRX, XTZ, ETC, Monero, XMR, ZEC, Ethereum ETH, DSH, IOT, LINK, NEM, NEO, Stellar XLM, BNB, BSV, DASH и другими.

Какие лицензии имеют брокеры других стран, де-факто работающие в Австралии?

Австралийцы имеют достаточно большой выбор брокеров, которые не имеют лицензии ASIC, но имеющие другие, не менее авторитетные европейские, американские или японские лицензии с которыми они охотно сотрудничают.

- в высшей лиге — это такие компании как Swissquote Bank SA, FXPro, FIBO Group, FOREX.com, Dukascopy Bank SA, Nord FX;

- во второй лиге, это Tickmill, ForexStart, Форекс Клуб (Forex club), Weltrade, AMEGA, Forex4you, ActivTrade, FreshForex, FortFS, EXNESS, NPBFX (Нефтепромбанк), TeleTrade (Телетрейд), eToro, RoboForex, LiteForex, BCS Forex и др.

Какие типы торговых счетов можно открыть у австралийских брокеров?

Брокеры, которые открывают доступ к финансовым рынкам не только трейдерам Австралии но и других стран, предлагают на выбор различные счета как для самих трейдеров, так и для инвесторов. У них всегда можно открыть

- — счета с виртуальными деньгами, которые разработаны для ознакомления с возможностями торговых платформ и условиями брокера. Тут вы можете отработать навыки торговли — как установить ордера Sell или Buy, уровни Buy limit, Stop Loss или Take Profit на медвежьих или бычьих трендах, как расчитать профит;

- счета ECN, NDD или STP с торговым лотом 0,01. Эти счета уже есть практически у всех брокеров; счета — такие счета уже открываются не только на криптобиржах, но и у обычных брокеров. Подробней — смотри Рейтинг брокеров криптовалют.

В Австралии, также, как и в ЕС, Японии или США регулятором запрещены:

Какие платежные системы используют брокеры Австралии?

Австралийские трейдеры кроме национальной системы POLi, также могут пользоваться всеми известными крупными мировыми платежными системами: VISA, Вестерн Юнион, Google Pay, Apple Pay, Mastercard, Wallet One, PayPal, Neteller, Skrill и другие, которые у австралийцев пользуются популярностью.

Иные рейтинги брокеров

Ниже вы можете посмотреть другие рейтинги брокеров форекс, составленные трейдерами Академии Masterforex-V:

- ; ;

- рейтинг лучших форекс брокеров; ;

- рейтинг брокеров Великобритании; ; ; ;

- рейтинг Форекс брокеров России; ; ;

- основной (комплексный) рейтинг брокеров Форекс; ;

- рейтинг брокеров с центовыми счетами; ; ; ;

- рейтинг Банков брокеров форекс;

С уважением, wiki Masterforex-V — курсы бесплатного (школьного) и профессионального обучения Masterforex-V для работы на форексе, фондовых, фьючерсных, товарных и криптовалютных биржах.

21 Best Forex Brokers Australia for 2022

The ForexBrokers.com annual forex broker review (six years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. Here’s how we test.

Trading forex (currencies) in Australia is popular among residents and international traders seeking an Australian-based broker. Before any fx broker in Australia can accept forex and CFDs traders, they must become authorised by the Australian Securities & Investment Commission (ASIC), which is the financial markets regulator in Australia. ASIC’s website is asic.gov.au. We recommend users also follow ASIC on Twitter, @ASIC_Connect.

After the Australian Securities Commission (founded in 1991) was dissolved, ASIC was established in 1998 as a national regulatory authority which reports to the treasurer and administers legislation for the Insurance Act of 1984, the Corporations Act of 2001, and the National Consumer Credit Protection Act of 2009. For a historical breakdown, here’s a link to ASIC’s webpage on Wikipedia.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers Australia

To find the best forex brokers in Australia, we created a list of all ASIC authorised brokers, then ranked brokers by their Overall ranking. Here is our list of the top Australian forex brokers.

- — Best overall broker, most trusted — Best web-based trading platform — Excellent overall, best platform technology — Great overall, best for professionals — Excellent all-round offering — Best for copy and crypto trading — Great for beginners and copy trading

Australian Forex Brokers Comparison

Compare Australian forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm’s ForexBrokers.com Overall ranking.

| Forex Broker | Accepts AU Residents | Regulated by ASIC | Average Spread EUR/USD — Standard | Minimum Deposit | Overall | Visit Site |

|---|---|---|---|---|---|---|

| IG | Yes | Yes | 0.828 | £250.00 | 5 Stars | N/A |

| Saxo Bank | Yes | Yes | 0.800 | $2,000.00 | 5 Stars | N/A |

| CMC Markets | Yes | Yes | 0.730 | $0.00 | 5 Stars | N/A |

| Interactive Brokers | Yes | Yes | 0.600 | $0 | 5 Stars | Visit Site |

| City Index | Yes | Yes | 1.100 | £100.00 | 4.5 Stars | N/A |

| eToro | Yes | Yes | 1.00 | $10-$200 | 4.5 Stars | Visit Site |

| AvaTrade | Yes | Yes | 0.910 | $100.00 | 4.5 Stars | Visit Site |

| FXCM | Yes | Yes | 1.400 | Starts from $50 | 4.5 Stars | Visit Site |

| Plus500 | Yes | Yes | 0.600 | €100 | 4.5 Stars | Visit Site |

| Admiral Markets | Yes | Yes | 0.800 | 100 | 4.5 Stars | N/A |

| IC Markets | Yes | Yes | 0.620 | $200 | 4.5 Stars | Visit Site |

| Capital.com | Yes | Yes | 0.800 | $20.00 | 4.5 Stars | Visit Site |

| XM Group | Yes | Yes | 1.600 | $5 | 4 Stars | Visit Site |

| Pepperstone | Yes | Yes | 0.770 | $200.00 | 4 Stars | Visit Site |

| FP Markets | Yes | Yes | 1.200 | $100 AUD | 4 Stars | Visit Site |

| Vantage | Yes | Yes | 1.220 | $200 | 4 Stars | N/A |

| Trade Nation | Yes | Yes | 0.60 | $0 | 4 Stars | N/A |

| ACY Securities | Yes | Yes | 1.200 | $50 | 4 Stars | Visit Site |

| Eightcap | Yes | Yes | $100 | 4 Stars | N/A | |

| VT Markets | Yes | Yes | 1.200 | $200 | 4 Stars | Visit Site |

| easyMarkets | Yes | Yes | 0.900 | $100.00 | 4 Stars | N/A |

| FOREX.com | Yes | 1.100 | $100.00 | 4.5 Stars | N/A | |

| Tickmill | Yes | 0.270 | $100.00 | 4 Stars | Visit Site | |

| HYCM | Yes | 0.600 | $100 | 4 Stars | Visit Site | |

| HFM (HF Markets) | Yes | 1.200 | $5 | 4 Stars | Visit Site | |

| BDSwiss | Yes | 1.500 | $100-$5000 (depending on account type) | 4 Stars | N/A | |

| BlackBull Markets | Yes | 0.845 | $50 | 4 Stars | Visit Site | |

| LegacyFx | Yes | 0.00 | $500 | 3.5 Stars | N/A |

Interested in stock trading? Read our guide to the best online brokers in Australia.

How to Verify ASIC Authorisation

To identify if a forex broker is regulated by ASIC, the first step is to identify the register number from the disclosure text at the bottom of the broker’s Australia homepage. For example, here’s the key disclosure text from Pepperstone’s website,

Pepperstone Group Limited is registered in Australia at Level 5, 530 Collins Street, Melbourne, VIC 3000, and is licensed and regulated by the Australian Securities and Investments Commission. Pepperstone Group Limited | ACN 147 055 703 | AFSL No.414530.»

Next, look up the firm number on the ASIC website to validate their current regulatory status. Here is the official ASIC page for Pepperstone.

More Forex Guides

Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read more about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.Read more on forex trading risks.

Continue Reading

About the author: Steven Hatzakis Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading CFDs, FX, and cryptocurrencies involves a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. All data was obtained from a published website as of 01/10/2022 and is believed to be accurate, but is not guaranteed. The ForexBrokers.com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the «Contact» link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.forexbrokers.com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with ForexBrokers.com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses ForexBrokers.com or any of its reviews, products, or services. ForexBrokers.com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG — 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

OANDA — CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909).

Reink Media Group (Ireland) ltd is acting in a capacity of a marketing affiliate of FXCM EU LTD.

Advertiser Disclosure: ForexBrokers.com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.g. exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Click here to see a list of our partners, and to learn about how we make money:.

Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While ForexBrokers.com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by ForexBrokers.com, nor shall it bias our reviews, analysis, and opinions. Please see our General Disclaimers for more information.

Источник https://www.fxempire.com/brokers/best/australia

Источник https://www.masterforex-v.org/wiki/brokers-australia.html

Источник https://www.forexbrokers.com/guides/australia